Detailed Explanation of DLMM Strategies

Meteora’s Dynamic Liquidity Market Maker (DLMM) offers an advanced toolkit for liquidity providers (LPs) aiming to maximize their participation in airdrops and improve their trading outcomes. Here’s an in-depth look at the strategies:

Concentrated Pools

Pairs like USDC/USDT or SOL/bSOL always operate within the same range. These pairs might not be the most thrilling, but there’s no issue with impermanent loss (IL) since both tokens have similar values. So, we can afford to set a very thin range to maximize fees. If the price goes out of range, you simply close the position, swap half of the balance, and open a new position with a new range. It’s like rearranging your treasure chest to fit more gold!

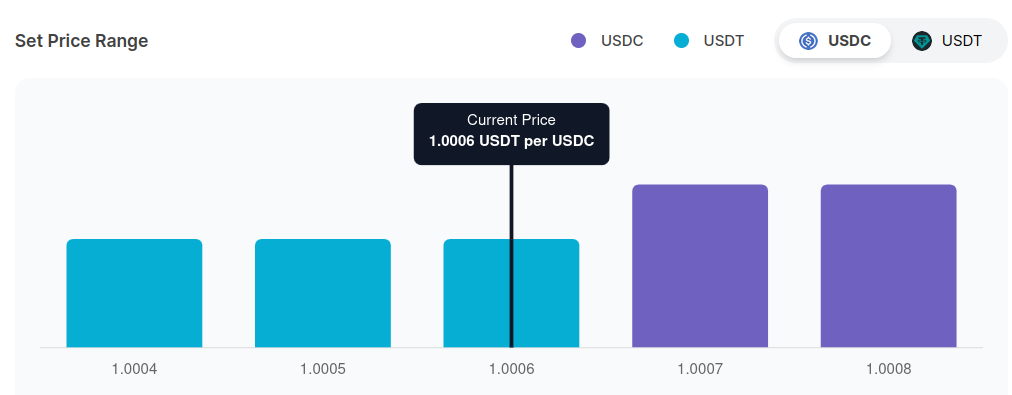

Let’s use the USDC/USDT pair to illustrate. Imagine looking at the trading pair chart over three months. You’ll notice the price mostly dances between 0.999 and 1.001. The bar on the left shows the volume for each pricing range.

The goal here is to set the pair bins that the pool will use to swap tokens. Because you want your bins to be as efficient as possible, you’ll set bins only for the range that matches where the trading volume happens. It’s like placing your treasure where the pirates (traders) are most likely to find it.

By doing this, your pool will almost always work at high capacity. If you’re up for some frequent tweaking, you can focus even more by using only 2 to 4 bins. This means more work on your part (since once you’re out of range, you must withdraw and swap half of your tokens to set up a new pool), but the fees are collected much faster this way. I’ve seen a 2x ratio between a 4-bin DLMM and a 12-bin DLMM.

Another option is to use more bins but fill them using the curve strategy proposed by Meteora. It’s like having a well-organized treasure map to ensure you get the most loot!

I’ve used these strategies to make very high gains, especially with high-risk coins. It’s like finding hidden treasure – a bit risky, but the rewards can be massive!

Correlated Tokens

- Suitable for beginners or those who prefer minimal rebalancing. This strategy covers a broader price range, providing a safety net against market volatility and ensuring a continuous fee stream.

Spot: Ultra Wide

- Extends liquidity across a wider price range, reducing the need for frequent rebalancing and accommodating larger market shifts. It’s best for LPs who prefer to set wider boundaries to capture long-term market movements.

Curve

- This strategy balances concentrated and distributed liquidity approaches. It’s best for those who can handle frequent adjustments and is particularly effective for pairs with mild price fluctuations.

Bid-Ask

- Tailored for LPs comfortable with high risk. It focuses on capturing fees within a narrow price range around a specific market price, requiring continuous rebalancing to remain effective.